China Loses Global Box Office Crown: Half Year Analysis

One exceptional film has propped up Chinese cinemas in 2025 and hidden the industry’s problems

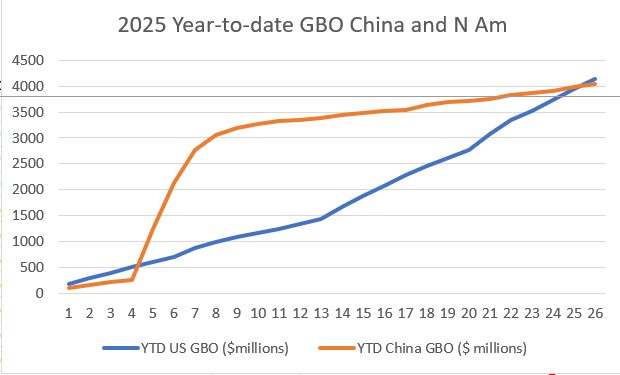

Chinese cinemas were the busiest in the world for much of the first half of 2025. But at the half year mark the momentum has slowed allowing the North American market to draw level.

Data shows that China’s lead over North America slipped in the last weekend of June, leaving its annual total at $4.051 billion (Chinese state media report RMB29.2 billion, while the dollar figure comes from Artisan Gateway). ComScore has the North American (aka ‘domestic’) figure for the same date at $4.132 billion.

The running total for China represents a 22% year-on-year increase in local currency terms (the dollar comparative from 30 June 2024 is $3.367 billion) and a recovery after FY2024 fell by 24% compared with 2023.

That must come as a relief for China’s cinema operators. But the current year trends are still some 12% behind pre-pandemic levels.

And there are now vastly more cinema screens in operation sharing that diminished revenue than there were before (see my January report in ContentAsia for more on this point).

But even taking the 2025 overall figure at face value is problematic. That’s because one film alone “Ne Zha 2” accounts for more than half of the six-month total.

Its $2.16 billion score is not simply exceptional. It is an outlier. It is the fifth biggest film of all time anywhere in the world, the highest-grossing animation film of all time anywhere. And it is the biggest Chinese film ever by more than a 50% margin. The number two Chinese film, “The Battle at Lake Changjin” earned – only – RMB5.77 billion or $805 million at current exchange rates.

The boost that “Ne Zha 2” has provided to BO total and cinemas’ coffers is also masking a number of serious problems that are now eating away at the mainland Chinese film industry.

These include high costs of production, an inward-looking industry with only modest export revenues and audiences that are slowly drifting to mobile phone-based forms of entertainment such as long-form streamed content, micro dramas and games. Add in a sluggish economy and the net picture is definitely darker.

“If we don’t change things, the entire industry could head towards decline,” said Wang Changtian, chairman of Enlight Media, and co-producer of “Ne Zha 2” at a forum at last month’s Shanghai International Film Festival.

“The film projects that I have seen recently still cost around the same to make as those during the peak of the market, but now both ticket sales and audience turnout are falling,” said Li Jie, president of Damai Entertainment Holdings (formerly known as Alibaba Pictures).

Wang’s proposed solution is two-fold. First is to increase the share of revenue flowing to producers, which he hopes will bring outside investors back into the sector. Second, he suggests focusing production on fewer, but stronger films.

He may be putting his money where his mouth is on this second point. Enlight is backing both “Ne Zha 3” and a feature film version of “Three Body Problem,” which is to be directed by the master Zhang Yimou. (The project was announced by Wang and the company that owns the rights to Liu Cixin’s underlying novel at Shanghai last year, but now seems closer to moving ahead.)

However, a shift to fewer tentpole films would increase the problem of polarisation or seasonality that already bedevils the Chinese theatrical business.

It is already highly dependent on holiday seasons, either national or official, or other seasonal marketing hooks, such as Valentine’s Day or Singles’ Day.

When these work they can lead to distortions, such as happened this when “Ne Zha 2” scooped the Lunar New Year pot but competing films struggled.

And when they don’t work, as happened with this year’s May Day holiday, there is weakness all around leading to audience disappointment.

The troughs in between the holiday periods are clear to see. In the first six months of this year, there have been no $100 million weekends other than those driven by the Lunar New Year titles. And 11 weekend out of the 26 so far in 2025 have seen nationwide takings less than $27 million – a truly miserable performance from 92,000 screens.

Chinese films are not the only ones struggling to attract Middle Kingdom audiences. Hollywood movies are lagging badly. Artisan Gateway reports that Hollywood titles so far this year have just 5.5% of the Chinese box office market and that Japanese titles claimed 2.2%. They are both dwarfed by the 91.2% share for Chinese-language titles. That is despite 14 revenue sharing US imports in the first half, compared with 12 in H1 2024. The import ban announced in April did not last long!

“Mission: Impossible – The Final Reckoning” is the highest US title so far this year in China with $61 million and is still on release. “How to Train Your Dragon” has $32.3 million to date and “Minecraft” has $29 million after a hot start. But – political issues aside – plenty more will be get their chance this year.

Chinese sources point to at least ten Hollywood titles that could boost the US domestic business this summer also unofficially preparing their outings in China before October’s National Day holiday. These include “F1: The Movie” that is already in Chinese theatres, a day-and-date release for “Jurassic World: Rebirth” and “Superman” on 11 July.

Chinese newspaper The Global Times noted, “Hollywood studios are also strategically aligning releases with the lucrative summer window.” That is a misleading assertion. Release dates for imported films are decided by Chinese authorities, which in many previous years have barred them from opening in the summer season, an action described as “Chinese film promotion month” or the “summer blackout,” depending which side of the argument one is on.